Discover Varsity Lincoln: Your Premier Resource for Lincoln Dealerships

Discover Varsity Lincoln: Your Premier Resource for Lincoln Dealerships

Blog Article

Grasping the Art of Working Out Reduced Prices on Automobile Leasing Agreements Like a Pro

In the world of cars and truck leasing agreements, the capability to negotiate lower prices can considerably affect the total expense and terms of your lease. It needs a critical technique, knowledge of the market, and a certain degree of finesse. As customers, we commonly overlook the power we hold in shaping the terms of our contracts, presuming that the terms offered are non-negotiable. Mastering the art of discussing reduced prices on auto leases can not only save you cash but also give you with a better understanding of the leasing procedure as a whole.

Comprehending Your Leasing Agreement

Furthermore, understanding the depreciation schedule detailed in the contract is crucial, as it straight affects your monthly payments. Devaluation is the distinction between the auto's preliminary worth and its expected value at the end of the lease, separated by the lease term. This expertise encourages you to discuss a reduced month-to-month payment by targeting a higher residual value or difficult filled with air depreciation estimates. Inevitably, a clear understanding of your leasing arrangement equips you with the expertise needed to discuss better and protect a favorable offer.

Researching Market Fees and Trends

To successfully work out lower rates on auto leasing contracts, it is crucial to conduct extensive study on current market rates and patterns. Researching market rates entails contrasting the expenses of comparable lease contracts supplied by various car dealerships or renting firms. By comprehending the average rates out there, you outfit yourself with useful understanding that can be made use of as utilize during negotiations.

Furthermore, remaining informed about market patterns is necessary. Variables such as the need for details automobile versions, the state of the economic climate, and even the time of year can influence leasing prices. When prices are likely to be more positive and time your negotiations accordingly., maintaining track of these fads can help you prepare for.

On the internet sources, market magazines, and also conversations with industry experts can offer useful understandings into present market rates and trends. By arming yourself with this knowledge, you can come close to arrangements with confidence and boost your opportunities of safeguarding a reduced price on your auto renting arrangement.

Leveraging Your Credit Rating

By recognizing how your credit rating rating influences leasing rates and terms, you can tactically leverage this monetary aspect to potentially discuss better terms on your auto leasing agreement. Your debt score serves as an essential variable that leasing companies consider when establishing the passion price and terms they offer you. By showing accountable credit rating behavior, you can enhance your discussing placement and possibly protect a lower rate of interest price and much more beneficial terms on your car lease.

Discussing With Self-confidence and Understanding

With a comprehensive understanding of the vehicle leasing procedure and equipped with expertise of market prices, you can with confidence work out positive terms for your lease agreement. Familiarize yourself with common leasing terms such as money variable, recurring value, and capitalized cost to guarantee you are well-equipped to talk about these facets with the leasing agent.

In addition, be prepared to walk away if the terms are not to your liking. Demonstrating a willingness to discover other choices can commonly motivate the leasing business to offer a lot more appealing rates to secure your company. Furthermore, leverage any kind of loyalty programs or discount rates you might be qualified for to further enhance your negotiating placement.

Exploring Different Leasing Options

An additional option to explore is a lease expansion. If you enjoy with your current automobile and its condition, extending the lease can be an easy means to continue driving the very same automobile without the hassle of returning it and locating a brand-new one. In addition, you might think about a lease buyout where you acquire the car at the end of the lease. This can be useful if the auto has actually preserved its worth well and you want to maintain it for the long term.

Verdict

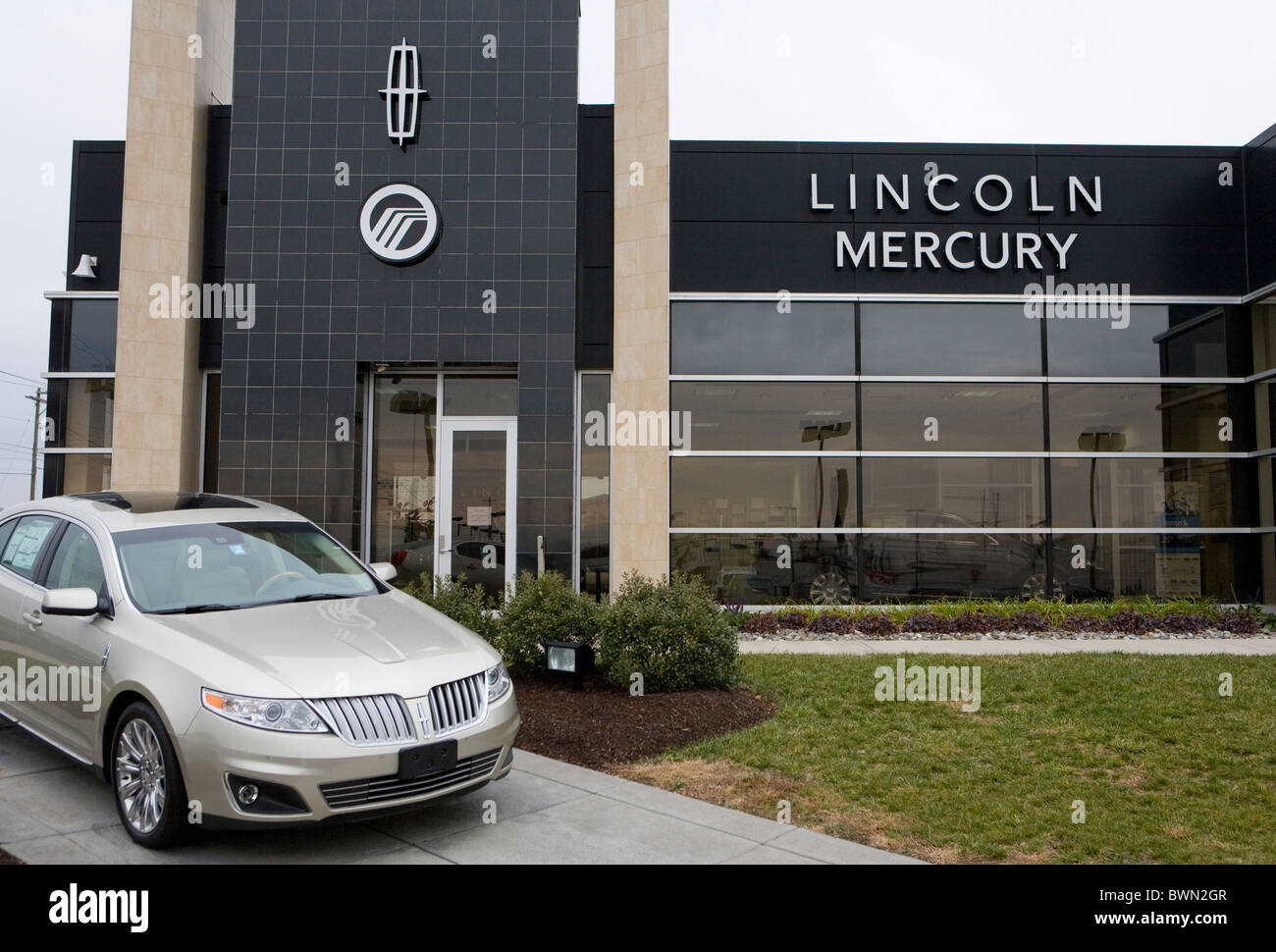

The leasing agreement serves as a legally binding contract in between you, as the lessee, and the leasing business, detailing the terms of the lease, consisting of monthly repayments, gas mileage limitations, maintenance obligations, and prospective fees. Devaluation is the distinction between the vehicle's preliminary value and its anticipated value at the end of the lease, divided by the lease term. Investigating market prices entails comparing the prices of similar lease arrangements offered by various dealers or leasing firms used auto dealers near me (lincoln continental).By understanding just how your debt score influences leasing rates and terms, you can tactically take advantage of this financial facet to potentially negotiate much better terms on your auto leasing agreement. In a lease requisition, you presume the continuing to be lease term and repayments of somebody looking to obtain out of their lease early

Report this page